A closer look into Addressable TV in Europe

Combining the high quality, brand safe scale of TV with the targeting precision and measurement capabilities of digital, Addressable TV (ATV) continues to be one of the most prevalent topics in TV and Digital advertising and gains more and more attention from the market daily.

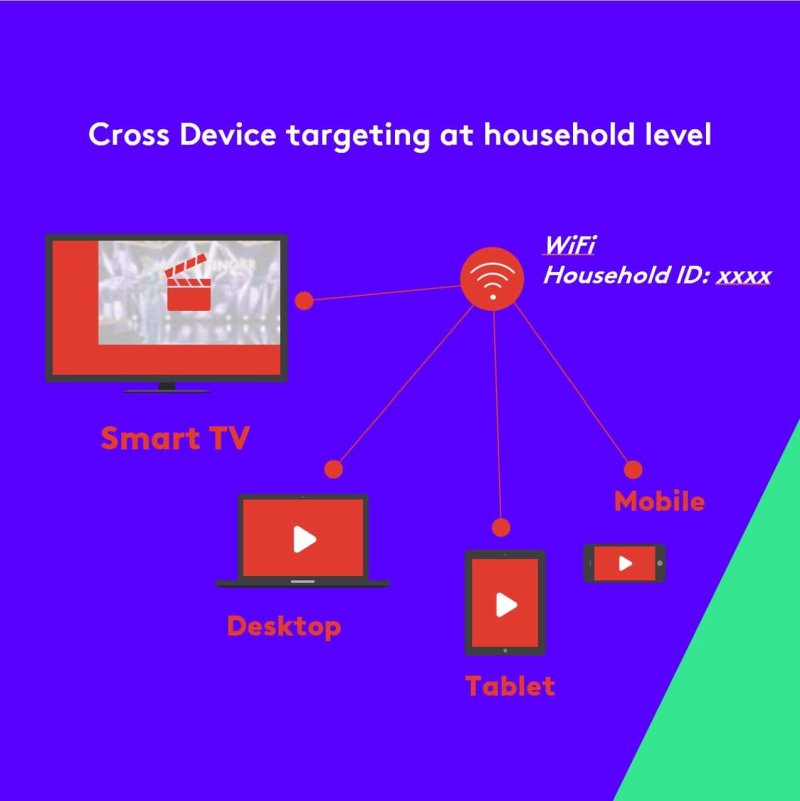

Thanks to ATV, brands are now able to enrich their media strategy by segmenting households based on consumption behaviour, optimise reach and frequency by connecting classic TV with ATV, target at a postcode level through geo-location and even address multiple screens within the same household by using cross-device technology.

Let’s take a closer look at what benefits these bring to advertisers and some of the latest developments in ATV across Europe.

ATV delivers brand performance results

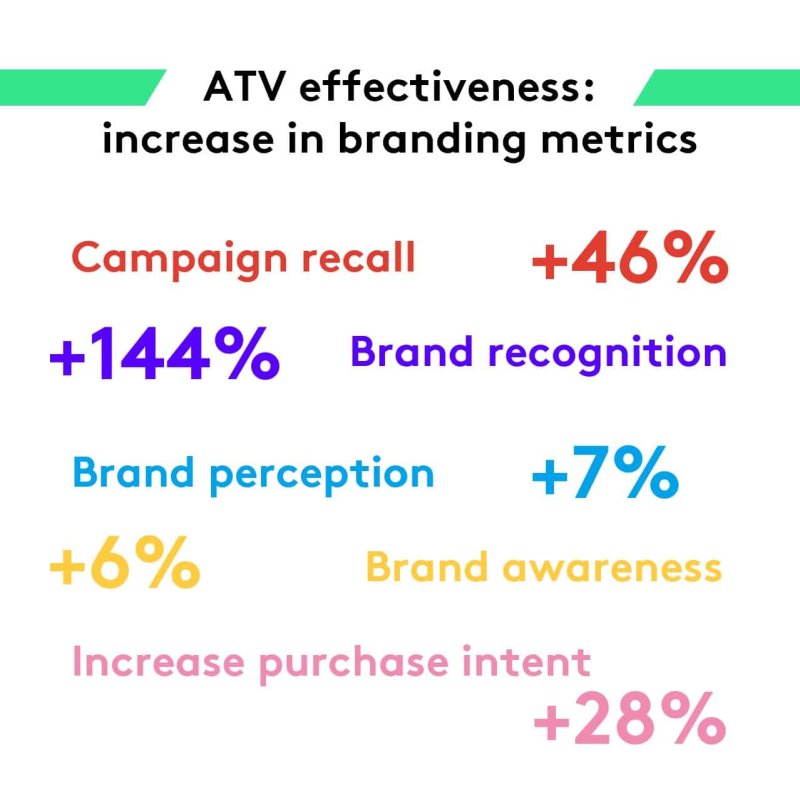

In the absence of established measurement tools (such as the use of panel data in traditional TV) and given the innovative and evolving nature of addressable linear solutions, broadcasters, advertisers and independent research bodies have invested a lot in measuring the effectiveness of ATV. Studies have shown that ATV campaigns can increase brand recall by 144% {1} and even lower funnel metrics, such as, purchase intent by 28% {2} . With the growing scale across Europe, more brands are adopting ATV strategies regardless of their wider media approach.

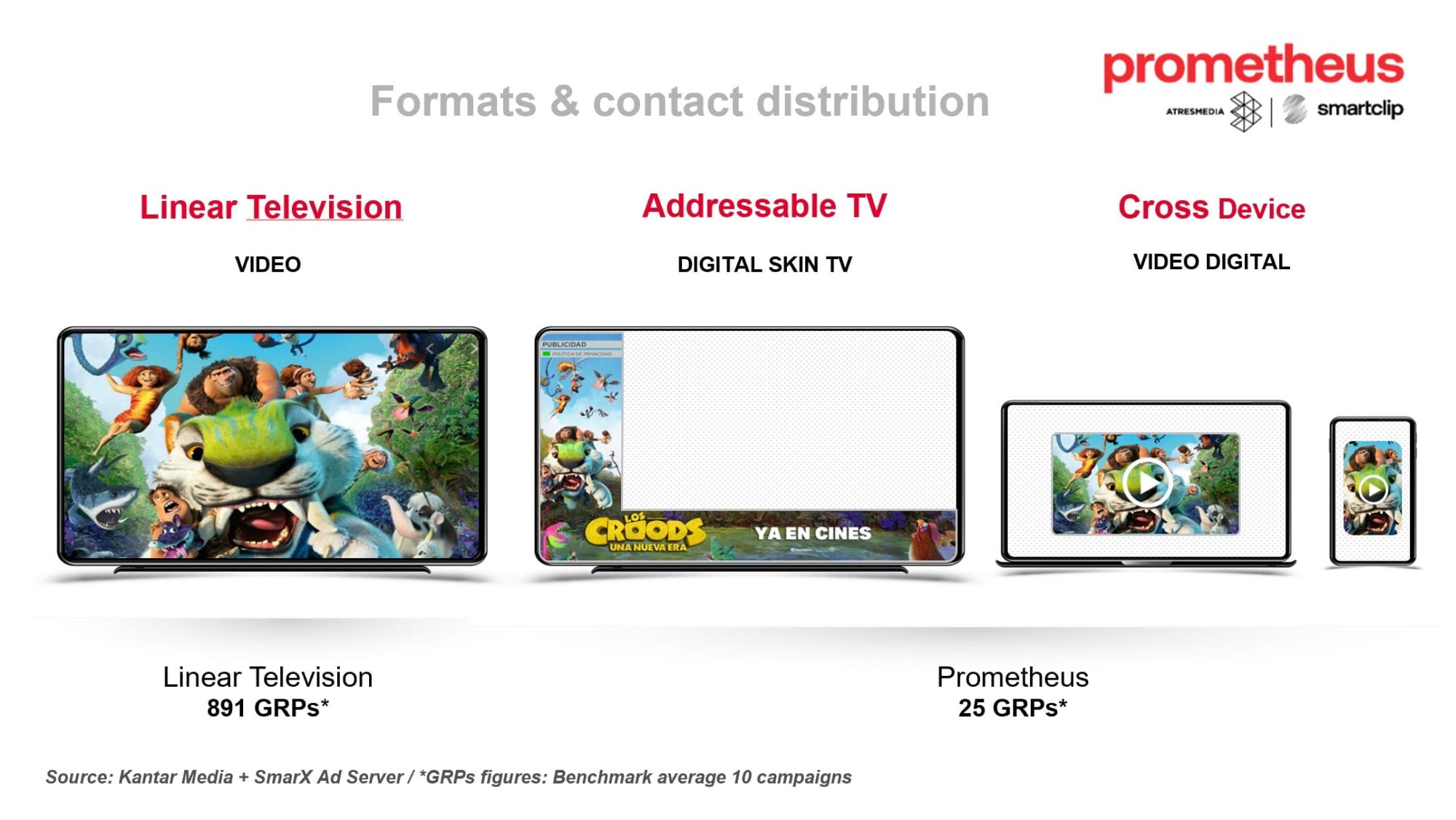

TV-first advertisers are using ATV to complement and strengthen their TV plans (an independent study in Spain showed that adding ATV to traditional TV increases de-duplicated net reach by 2.55-4.66 points){3} . Digital-first advertisers seek to create complete and holistic digital plans by adding household level targeting on the largest screen in the household. ATV also offers a solution for those looking for lower-entry and efficient access to TV, meaning that even smaller brands can now access the power of TV advertising through ATV.

Different Addressable TV models across Europe

With the fragmented media landscape across Europe and differing technological methods, the term is also being used in various contexts, leaving many of us more confused about what exactly it is. It is helpful therefore to consider Addressable TV as an umbrella term that, simply put, comprises showing different ads to different audience segments watching the same TV channel or programme.

These addressable capabilities have been established across Europe to varying degrees through OTT catch-up platforms (broadcast, advertising, or subscription video on-demand) but are more impressively now integrated into a growing number of linear transmissions, allowing for segmented advertising within traditional broadcast channels. In Europe, these differing technologies include HbbTV (an operating system within the smart TV device allowing for the overlay of various formats in and out of the ad break) and IPTV (a set-top box delivering the linear signal through an internet connection allowing for a video spot replacement within the linear ad break).

Recent partnerships increase opportunities within Germany’s already mature ATV market

One of the earliest addressable linear markets is Germany, which launched around 6 years ago with the advent of the simple yet effective L-Banner format, delivered optimally within seconds of a user switching channels. The Ad Alliance’s results attest to the exponential growth of these solutions in the market, as Addressable TV revenues increased by 38% between 2019 and 2020 and the market size is set to increase tenfold within the next 5 years. Though the L-Banner has been proven to open incremental targeting opportunities for brands and revenue potentials for broadcasters for several years, the adoption of video formats has grown significantly in parallel, contributing to roughly 15% of ATV revenues in 2020.

As ATV continues to grow in Germany, broadcasters are also adapting. All ad-financed German broadcasters have integrated ATV solutions into their infrastructure, quite unique in Europe. Although the penetration of HbbTV is mature in this market, further growth requires forming more partnerships to increase data sets for even more reach and advanced targeting. Broadcasters could strategically look, therefore, to partner with Telco providers, as has the Ad Alliance in its integration with MagentaTV, a partnership with market leader Telekom Deutschland.

Another unique innovation includes the creation of data sharing partnerships between broadcasters and advertisers. By using data from a brand’s DMP or website traffic, broadcasters can match and build relevant segments at household level and make them available for ATV targeting on the big screen. Combine this with the ability to deliver cross device advertising to other digital devices within the same household, and you have a holistic and incredibly compelling TV & Digital execution.

ATV is one of the broadcasters’ survival strategies.

A gate is opened for the French ATV market

In France, 80% of the household market has a digital reception, split into 70% using IPTV set-top boxes and 10%, almost 3 million households, with HbbTV enabled smart TV devices. Whilst the use of the latter as an ATV advertising solution is currently exclusively offered by M6, changes in French broadcast regulations have opened up ATV potentials for the wider market. French broadcasters can now leverage the larger potential of IPTV to offer video spot replacement to advertisers. 2021 has marked only the beginning for this opportunity, where the French addressable market currently stands between 5 to 7 million households but is expected to grow rapidly to reach 16 million households by 2023 {4}.

Partnerships are also key for the success of the French ATV market. Firstly, French broadcasters are dependent on the ISPs to run their ATV solutions, M6, like TF1 and France Télévisions, collaborates with Orange and Bouygues. Secondly, additional data partnerships are also necessary to optimise the use of broadcasters’ and clients’ data sets. M6 have also partnered with RelevanC, which manages data from retailers, to complement its own first-party data sets, however at present this is only available with its HbbTV solution but expected to open up to IPTV in the coming months.

France’s ATV landscape certainly has a lot of promise, but is still in its infancy since the industry faces three major challenges. Essentially, more market standardisation is needed to increase the reach and facilitate the measurement of ATV campaigns. Operators also need to update the technical delivery by upgrading to next generation set-top boxes, which would significantly increase the addressable audience. Furthermore, the issue of data consent needs to be solved, meaning adhering to legal requirements whilst maximising reach potentials. Ultimately broadcasters need to collaborate further with ISPs to increase the amount of data available to them.

Now that we have the abilityto target more preciselywe now, for the first time,have the opportunity to loweRTHe entry ticketfor TV campaigns.

The dominance of free-to-air TV in Spain gives way for greater ATV potential

Unlike France, Spain’s dominant method of TV distribution is free-to-air digital distribution through smart TV sets, since only one in three households subscribe to Pay TV set-top box offerings (such as Movistar, Vodafone or Orange). This means that HbbTV is the main driver in Spain’s Addressable TV market, with 11.1 million compatible smart TV devices.

Spain is unique within the European ATV market due to one of the leading broadcast groups, Atresmedia, partnering with independent research bodies to offer the “VAR” (Video Advertising Reach) advanced measurement tool, which uses a single currency and allows advertisers to compare the effectiveness of ATV campaigns. Originally a cross-media tool for TV and Digital, it was recently enhanced to include ATV with the aim of achieving even greater de-duplicated reach. The results of the VAR tool are a strong example of exactly what the market is looking for, and is driving a lot of the complementary TV and ATV strategies in Spain.

Atresmedia have taken this one step further by offering the “Prometheus” project, a live reach and frequency optimisation product using the data from HbbTV enabled smart TV sets to target low-exposed viewers to a linear TV campaign, with Addressable TV and Online Video campaigns. Unique reach can be increased by up to 6.4 pts and the cost of incremental net reach points can be significantly reduced at the point where linear TV reach tends to saturate.

ATV’s greatest added valueis innovative data-drive segmentation, and incrementalreach within the TV environment.

Media agencies are well-geared to deliver and measure the value of ATV

ATV solutions provide media agencies with an attractive prospect for their clients who want to maximise reach through every digital touchpoint. The two leading addressable linear solutions in Europe, HbbTV and IPTV, used in combination with one another, can also drive performance. Video and audio-visual tools reinforce emotional connection and brand uplift, whereas innovative display formats on the big screen can prompt consumers to purchase. This mix has massive implications for branding and sales and is therefore highly appealing for an agency’s clients.

Some of the main challenges in the ATV space today are to do with measurement, as well as the general fragmentation of technologies and offerings available to the buy-side. The former makes accessibility and scale difficult in an already convoluted market, whereas the latter poses challenges mainly to TV buyers who operate in the world of GRPs, who seek to navigate the value ATV brings despite its difference in measurement and currency. If its solutions could all be made accessible within a single marketplace, access would be simplified to the market and there would be hope in establishing consistent measurement through such a unified platform.

However, agencies cannot allow these challenges to prevent them adopting ATV strategies within their media mix. They are fortunate enough to be well-geared in proving effectiveness and value in the absence of unified measurement platforms. Media mix modelling, for example, where GRPs and CPMs, or any other mechanism in terms of buying, are removed and the modelling is used instead to show the performance of individual channels and touchpoints to the ultimate goal, either sales or conversions, is one such method for measuring this effectiveness.

Whilst we eagerly anticipate exciting developments and, inevitably, the establishment of new products, business models, and measurement tools, what is clear is that ATV cannot be ignored. And though we see that we are only at the beginning, we expect to see more collaboration between industry colleagues and competitors to create a more unified ATV marketplace. In the meantime, advertisers and media agencies should focus on its practical application and value in enhancing brand performance and ROIs.

Kourosh Ayrom, Head of ATV at RTL AdConnect

For me, the best thing about ATV is that it marries the best of traditional TV ads with the best of digital.

Sources

[1] Source: base: low chance of exposure n= 653, medium chance of exposure n= 945, high chance of exposure n=759/Question: “You’ll now be shown advertising for XX. Have you ever seen this advertising before?”2.

[2] Source: Purchase Intent base: TV only n= 517 , TV+ATV n= 583/Question: “How likely are you to (re –)purchase the product from the XXX?”

[3] Source: Atresmedia May 2020; Data of additional points of % June 2020

[4] M6 Publicité