What’s new with Addressable TV?

Addressable TV (ATV) advertising with the development of Connected TV, is a cornerstone of increased targeting capabilities within broadcast groups, especially in Europe and the US.

Collaboration between tech companies, like smartclip, and broadcasters is key to rapidly achieving full addressability of the traditional broadcast TV ad break. In this Q&A, Sebastian Busse from smartclip addresses key challenges, opportunities, and solutions for advancing ATV across Europe.

What does the ATV global landscape look like today?

While ATV has gained tremendous traction across global markets, Europe has a vastly diverse and unique playing field. Unlike other markets, the pan-European Hybrid Broadcast Broadband TV (HbbTV) standard has been the driver for ATV across Europe. The HbbTV standard allows broadcasters a controlled solution for ATV within the traditional broadcast environment. From a technical point of view, this means that broadcasters have complete control over the entire value chain – from content distribution to monetisation.

How has Covid-19 impacted the development of ATV?

There is no doubt that Covid-19 has had a deleterious impact on the entire advertising industry as most brands have massively cut back on their advertising budgets. However, when we look specifically at ATV, there have been many positive trends and developments despite the overall economic situation. It even seems that the pressure on the economy caused by Covid-19 has accelerated some developments and decisions. For example, Germany continues to show growth in ATV budgets year-on-year. Italy and Spain have successfully launched their crossdevice solutions, utilising ATV data. And in France, legislation has been introduced that finally allows ATV advertising at a larger scale. This new law annuls a 1993 ordinance that prohibited the use of targeted video ads in broadcast TV.

What are the technologies behind Addressable TV across regions?

There are some ATV solutions that, like in the US, require proprietary hardware. For example, the most advanced ATV offering in the UK is Sky AdSmart, which requires Sky set-top boxes. Smart Ad in Belgium and Orange in collaboration with Canal+ in France are other examples of ATV concepts within IPTV environments that are tested in Europe. However, the open pan-European HbbTV standard – which a vast majority of smart TVs sold in Europe carry – is the main market differentiator. HbbTV provides broadcasters with a controlled environment to implement ATV at scale. In short, HbbTV provides an infrastructure to merge the traditional broadcast signal with digital ad technology. smartclip uses this technology to capture real-time viewing data on a one-to-one device basis and serve targeted digital ads into the conventional broadcast stream.

What are the opportunities and challenges across regions? What needs to be done to overcome the obstacles?

ATV products already exist in all major markets in Europe. Surprisingly, a lot of important information gets lost in discussions surrounding definitions, technology standards, legislations, and data privacy. There is no consistent understanding of ATV advertising and its capabilities across the region. This leads to uncertainty and ultimately restraint, especially on the buying side. Establishing more clarity around how ATV differs from established digital video products will help advertisers and agencies make better decisions regarding their advanced TV ad strategy. It needs to be made clear what products are available in each market and how they are accessible for the demand side, but also what capabilities, formats and benefits are provided.

How do you differentiate Addressable TV from established digital video products?

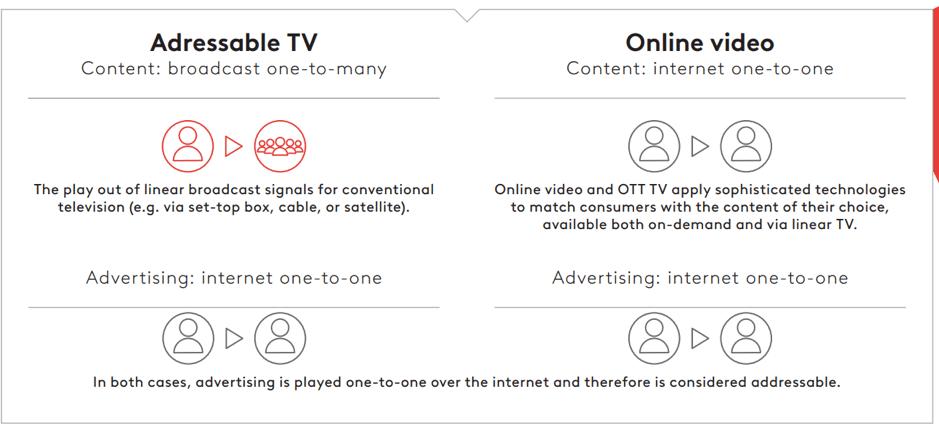

A meaningful distinction of ATV from other online video advertising techniques is directly related to the requirements of ad distribution and content delivery. ATV has been primarily established as a playout of adserver-based advertising in classical one-to-many broadcasting. For Online Video and OTT TV, both content and advertising are distributed one-to-one with digital technologies.

What are the 3 major initiatives in the area of ATV in 2020?

First, we have successfully launched our cross-device product in Germany, Italy, and Spain. With this product, we provide advertisers with the ability to target online video campaigns based on linear TV usage data. For example, advertisers can extend their TV campaigns into digital by specifically targeting users who have not yet seen their TV campaign. Another significant advance is the launch of the full ad break replacement. In Germany, we are now in the final phase of implementation into broadcasters’ infrastructure and we have started in Spain. Later this year we will see the first cases of ad replacement within the linear TV ad break. The third topic is programmatic access to addressable linear TV. We have now reached a more mature stage of ATV in Europe and advertisers demand the ability for programmatic buying. In Germany, we have already established d-force (a joint venture of RTL and Pro7) as the exclusive platform for programmatic buying of ATV inventory. We also see the need for programmatic solutions to access ATV that are under the control of broadcasters in all other European markets. As the largest ATV platform in Europe, we are striving to establish a pan-European standardisation of programmatic ATV buying. We already have the necessary technology and commitment from major European broadcasters, and we are now in the final phase of commercials and defining the go to market. Stay tuned for the last quarter.

Sebastian Busse, Director Addressable TV International at smartclip