A Global Tour of Brand Innovations and Emerging Sectors

2020 marked a turning point in human history as the pandemic disrupted society as a whole. TV advertising reflected these changes, acting as a platform to boost brands and highlight innovative products.

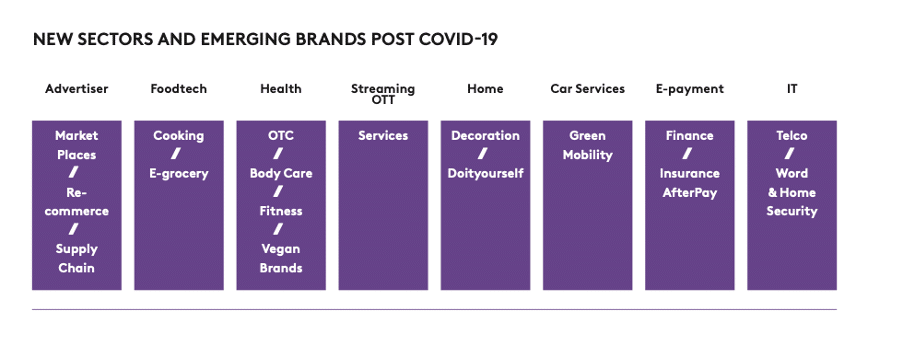

Here we take a global look at the latest consumption trends, the new players and emerging brands we expect to see on European TV screens in the coming years.

CONSUMERS HAVE CHANGED THEIR DAILY ROUTINE

The new office at home

Covid-19 spared no sector of the economy. It brought about structural change in all our lives as remote working became a reality and shifted our work/life balance. Home become the office and that has directly impacted the way in which people consume media, buy products and allocate time to different activities.

A recent Nielsen survey revealed that in the US, as a result of remote working, two out of three people consume more media. Streaming services are used for multitasking whilst working, whether that means listening to the radio or streaming TV. Another shift in behaviour concerns sleeping patterns.

In the US, 54% of workers who worked from home due to COVID-19, now get up later than they did in 2019 and nearly half hit the sack later than they did when they were going into the office. This new ‘free time’ can be allocated to online shopping and browsing the web, which creates new business opportunities for marketers, and accelerates the emergence of new products and consumer habits.

This trend is likely to continue into the post-Covid world. A recent German study (Ad Alliance) indicated that, if possible, almost half of German respondents would like to work from home as much as in the office. During the lockdowns, people completely changed the way they manage their time and consume.

DURING THE LOCKDOWNS, PEOPLE COMPLETELY CHANGED THE WAY THEY MANAGE THEIR TIME AND CONSUME

Consumers’ health and expectations

The same study revealed that 74% of Germans are paying more attention to their health, a trend that has been steady since the first wave of the pandemic[1]. This trend is also true in the UK, where there has been an increase in gym membership as people have become more concerned about their physical and mental health. Living consciously is a growing trend across Europe and during the crisis, consumers awareness of sustainability increased.

81% of German respondents say they want to consume in a more responsible way and 70% want to adopt a more sustainable lifestyle[2]. In addition, 37% of Europeans surveyed plan to eat less meat[3] hence the success of vegan brands, such as Quorn Foods or Beyond Meat.

CONSUMERS ARE SPENDING DIFFERENTLY: EMERGING SECTORS AND PLAYERS

Certain sectors took advantage of changing consumer attitudes and lots of new players appeared.

In particular, new global ecommerce platforms have flooded the market, offering new shopping experiences and services such as Click & Collect, return shipping, deliveries, or payment options.

These players now also offer easy access to products and services from home.

Online shopping

Over the course of lockdown, the e-grocery trend exploded across Europe. In Spain, twice as many consumers shopped online in 2020 compared with 2019[4]. These changes are likely to be long-term, for example in the UK, half of shoppers plan on spending more on online shopping. However, this is a local phenomenon, with new companies emerging in already competitive environments.

As a direct consequence of this global online shopping boom, a new ecosystem has emerged, with direct-to-consumer brands (D2C) and new platforms managing customer supply and demand for every category. Uber led the way with mobile solutions for travel, whilst Netflix has revolutionized the TV streaming experience. Local players have emerged in all sectors including fashion, food, furniture, consumer goods, cars, cosmetics, health, fitness and the second-hand mar¬ket.

As a result, of this digital and dematerialised ecosystem, a range of new players is stepping in with new e-payment, insurance and money security solutions.

E-commerce and re-commerce

The second-hand market is growing fast with Depop, Vinted, Vestiaire Collective and Etsy seeing their user figures skyrocket.

According to our May 2021 study in collaboration with Sociovision, 34% of surveyed people across France, Germany, the UK and Italy stated that they intend to buy second-hand clothes, and 43% say that they sell unused clothes.

Our latest study for Christmas 2021, reveals a similar mindset – 29% of British consumers surveyed say they would prefer a second-hand present.

AS A RESULT OF REMOTE WORKING, TWO OUT OF THREE PEOPLE CONSUME MORE MEDIA AND SCREENS

Consumers spread the costs

‘Buy Now, Pay Later’ is an increasingly popular payment solution across Europe, particularly among the under-35s, according to several studies. These payment methods are especially popular around big spending times such as Christmas[5] for purchases such as clothes or beauty products[6]. Retailers will have to adopt this option if they do not want to lose potential customers.

Customers establish stronger and more trusting relationships with brands that offer these types of payments. New players such as Square, Sumup and Afterpay (a German app launched by the financial department of Bertelsmann) have joined global players such as PayPal, Visa and Mastercard. Of these brands, PayPal is the one that consumers trust most to provide their banking services[7].

The growth of online banking is a challenge for traditional banks. In this competitive sector, banks need to increase their user base, which relies on the creation of user-friendly apps to encourage downloads. Consumers are seeking change in this sector and want safe environments in which to make payments.

Unicorns are shaking up the market

Many of these new brands come from outside Europe, in particular, from North America and Asia.

We saw this during the 2020 UEFA European Football Championship (the Euros), which was sponsored by a number of Chinese brands seeking to boost their brand awareness in Europe. These included: Oppo, from the telecoms sector; AliExpress, an e-commerce site; and TikTok, a social media platform.

Unicorns – or start-ups – are becoming increasingly powerful. Year on year, their success is growing, regardless of their sector or geographical area. They have revolutionized the markets thanks to their innovative approach, scale, vision, and financial means.

According to CB Insights Unicorn tracker, there were 728 Unicorns in the first half of 2021 – 50% coming were from North America, but a growing portion (30%) are from Asia. Collectively, these tech start-ups are worth over $2 trillion and have raised a combined total of more than $485 billion.

A growing proportion of these brands come from emerging sectors such as AI, EdTech and Cybersecurity. We can expect a lot of innovation and initiatives in these industries in the future.

UNICORNS HAVE REVOLUTIONIZED THE MARKETS THANKS TO THEIR INNOVATIVE APPROACH, SCALE, VISION, AND FINANCIAL MEANS

WHAT’S NEXT?

The US and China

China and the US are battling for leading the world of innovations. In China the focus is on tech and innovation, with less regard for the climate crisis. By comparison, in the US, sustainability, health, wellbeing, biotech and security are gaining traction.

The Chinese government’s 14th Five-Year Plan for 2021-2025 announced in March 2021, sets the tone for how the world could look in five years. The top priority is increasing R&D spending and doubling efforts in innovation.

According to Bloomberg’s calculations, this would bring China’s R&D expenditure to 490 billion euros, almost ten times that of the European market and considerably more than US’ investment which reached 461 billion euros in 2021.

This changing landscape, with emerging brands, platforms, trends, and expectations begs only one question… What will the world of tomorrow look like? /

Christophe Loisel, Deputy General Manager & Strategic Business Development Director at RTL AdConnect

Sources

[1] Source: Ad Alliance – The Corona pandemic and its impact on everyday life / Basis: 8th wave n=600-921 / Question: “How happy are you about easing in these areas?”

[2] Source: Ad Alliance – The Corona pandemic and its influence on everyday life / Basis: 8th wave n=934

/ Question: “Imagine a time after the end of the COVID pandemic and a return to normality. How much do you then agree with the following statements?”;

[3] Source:RTL AdConnect and Sociovision–The Responsible Brands in Europe Study, October 2020, Survey on 1000 respondents 18-64 per country;

[4] Source: Cetelem- Spain « Observatorio Cetelem de Consumo en Espana 2020: El dominio de la tienda online en el consumo de 2020 » conducted by Canal Sondeo, Oct29, 2020 Ages 18-65, numbers may not add up to 100% due to rounding;

[5] Source : TGI France 2020R2 October (Kantar Media);

[6] Source: Kearney, “Credit uncrunched: why banks and retailers must develop more PoS credit services,” Jan 28, 2020;

[7] Source: Insider Intelligence banking digital trust survey, Q1 2020, n=2,055 Q: Which of the following would you trust most to provide you with banking services?