The Total Video habits of connected TV owners

With nearly 70 million devices in Europe – and a seamless advertising experience that harnesses data, technology, and scale – Samsung Ads has helped drive the shift from TV to CTV, offering a unique perspective on where audiences are heading next.

By combining usage data from its connected TV sets, Samsung Ads provides exclusive behavioural insights to help advertisers and agencies better capture consumer attention in an increasingly fragmented video landscape.

Samsung TV owners are heavy streaming users

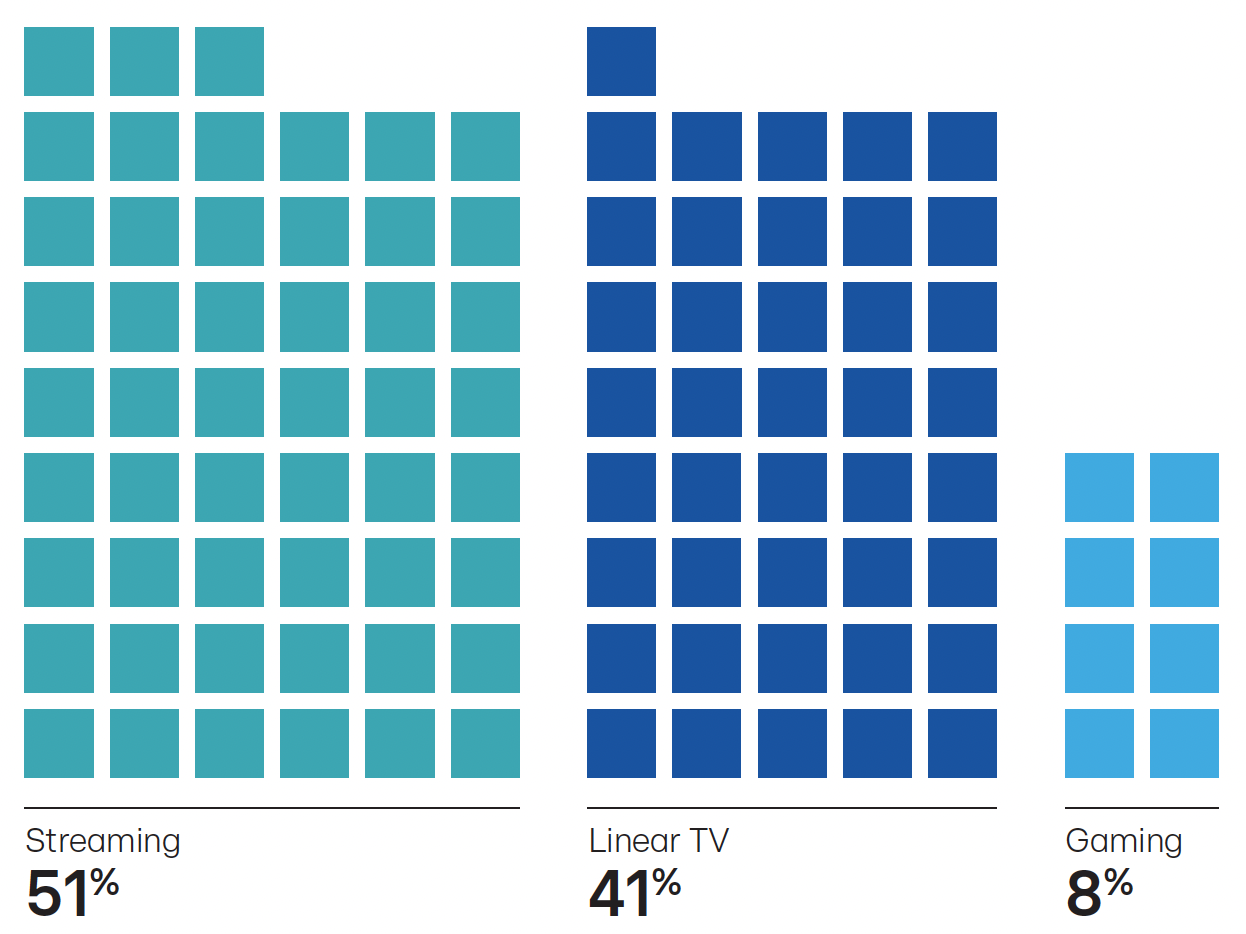

Time spent by usage type on Samsung connected TVs in 2025, EU5

Connected TV users show distinct behaviour – with streaming accounting for 51 per cent of time spent on the device, compared with 41 per cent for linear viewing, and 8 per cent for gaming.

The growth of apps

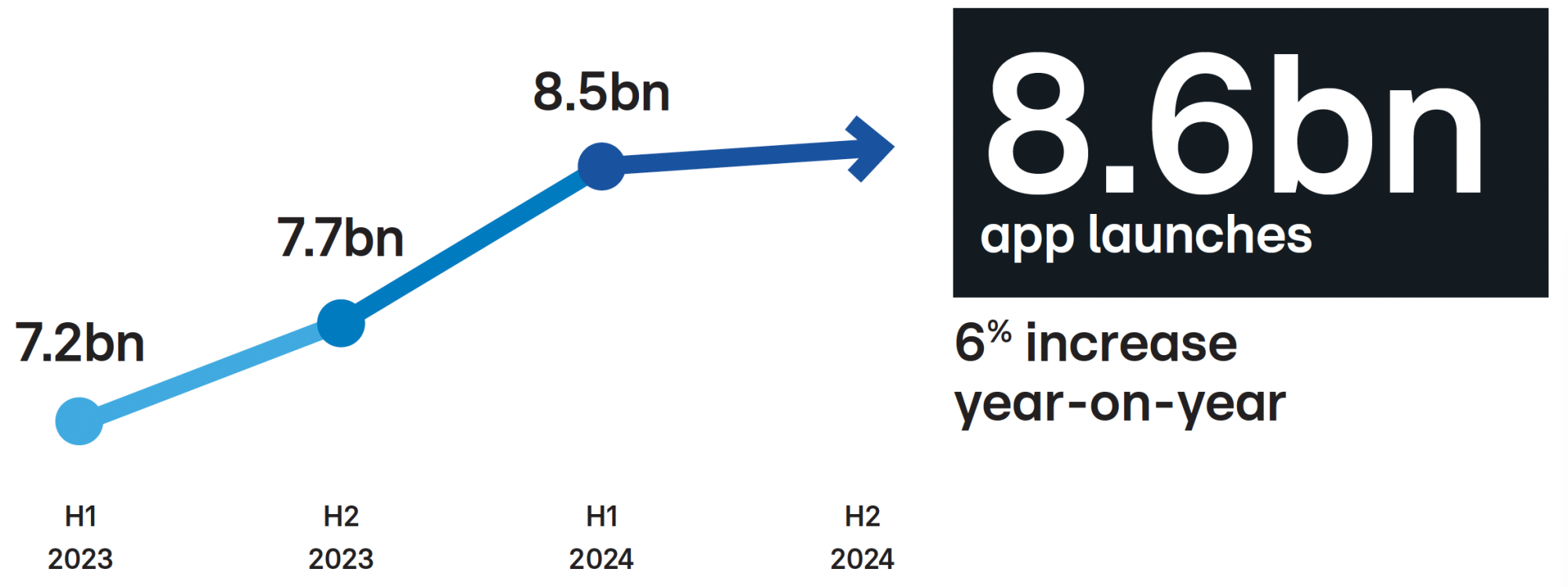

Traditional television involved a handful of channels broadcasting in real time, but streaming has ushered in a complex ecosystem in which hundreds of apps serve vast amounts of content on demand. In the second half of 2024, apps were launched 8.6 billion times a day on Samsung TVs across the UK, France, Germany, Italy, and Spain – a 6 per cent year-on-year increase. This indicates users are spending more time on apps on their TV and less on linear TV, but that their viewing is more fragmented than ever.

Connected TV users show distinct behaviour – with streaming accounting for 51 per cent of time spent on the device, compared with 41 per cent for linear viewing, and 8 per cent for gaming. CTV app usage continues to increase: audience adoption of apps grows year-on-year

Source: Samsung Consumer Electronics Proprietary Business Intelligence based 2023 and 2024 data, EU5.

TV's mass audience has scattered

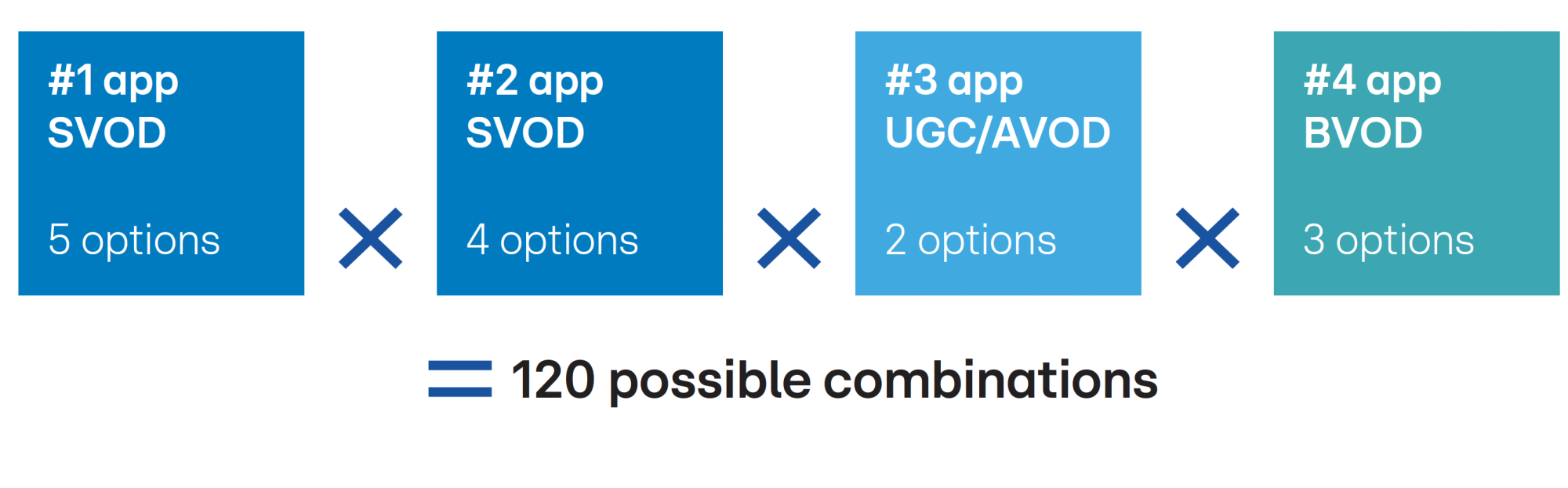

Possible app bundle combinations within the top 10 apps

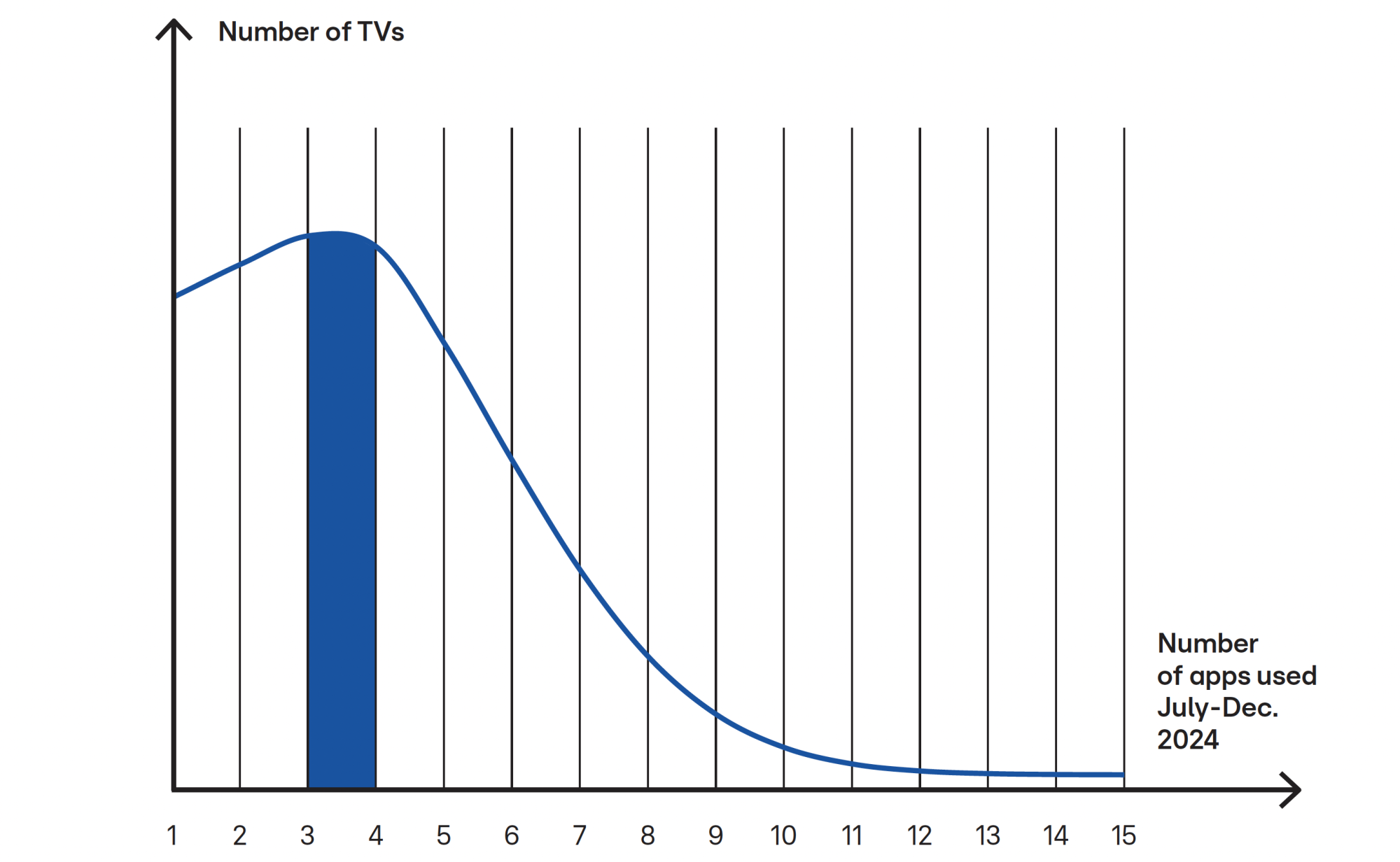

The average number of apps used per TV in EU5 is around 3-4

Most households are faithful to three or four apps for viewing – typically, two subscription video on demand (SVOD) services, an advertising-based video on demand service (AVOD), and a broadcaster video on demand (BVOD) service. But the number of apps available in any one of those categories – and therefore the huge range of possible combinations in any given household – has led to a scattering of the TV-watching audience across many environments. The growing convergence of smartphone-like app usage on TV means mass audiences are no longer engaging with content in a single, predictable way. As a result, it is increasingly difficult for brands to reach a mainstream audience.

Fragmentation for viewers and brands

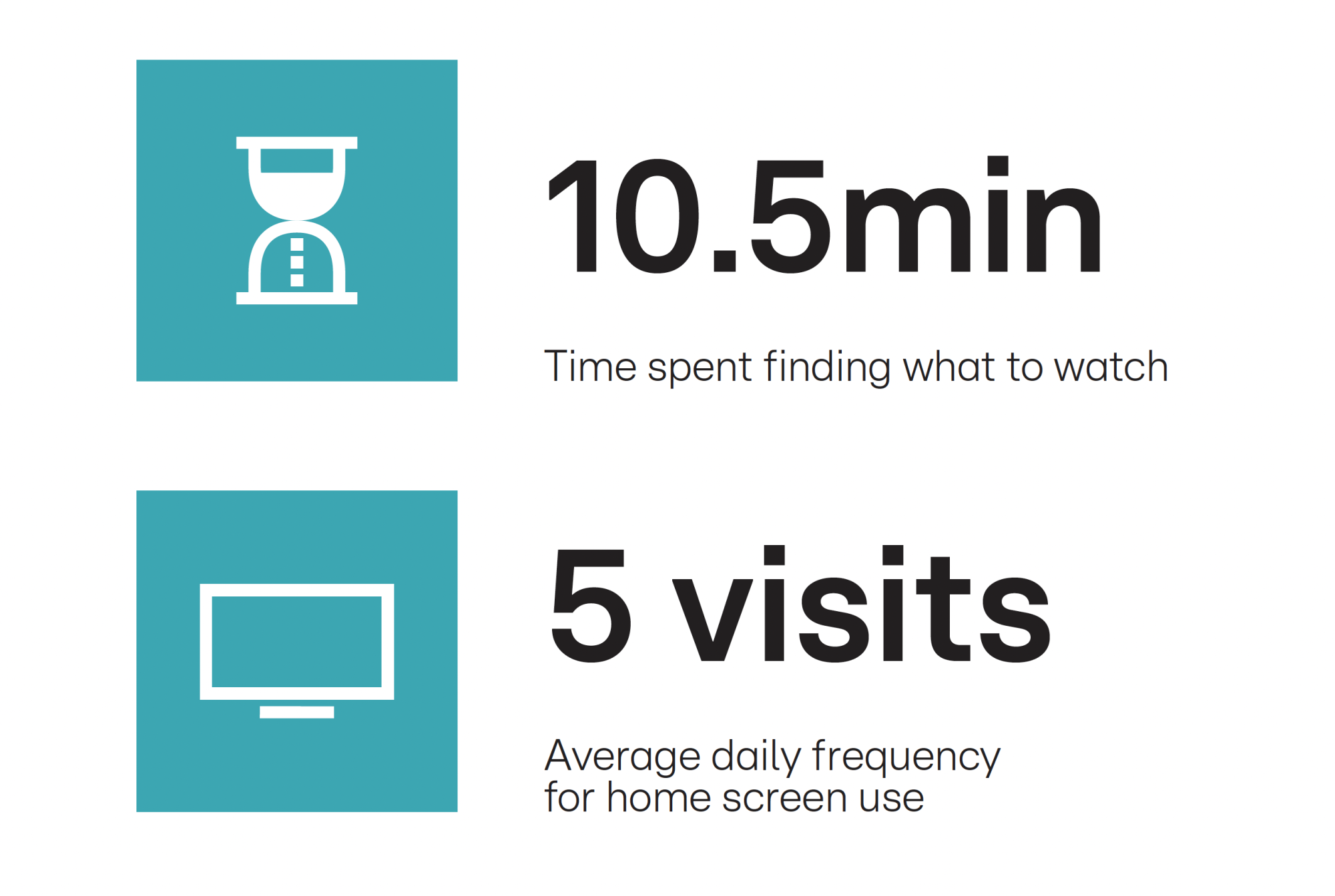

If brands are frustrated, so are viewers. Given the quantity of content on offer, they are spending longer than ever choosing what they want to watch – up to 10.5 minutes on average.

Dependable search is a priority, and in a fragmented space, the role of the home screen as the hub of discovery on the TV is increasingly critical. Samsung TV users, for instance, visit the home screen five times a day, on average.

For advertisers and users, the home screen has emerged as a solution to fragmentation: the launchpad to TV moments of all kinds.

Source: Samsung Consumer Electronics Proprietary Business Intelligence based 2023 and 2024 data, EU5.

Samsung Ads

Samsung Ads is Samsung’s advertising division, delivering targeted, data-driven campaigns across Smart TVs and devices, helping campaigns reach audiences globally with measurable, high-impact video, and display solutions.