Has the evolution of digital audio given advertisers more opportunities?

As TV continues to go from strength to strength throughout the pandemic, the digital audio market is also set to take off. Audio is omnipresent in daily life, 86% of French people listen to a form of audio every day[1], and the market is starting to see the emergence of new powerful mediums. Although live streaming radio formats have been around for a while, podcasts and audiobooks have recently caused waves in the market. As part of their annual revised 2020 TMT predictions, Deloitte expected the global audiobook market to grow by 25% to US$5 billion and the global podcasting market to increase by 30% from 2019 to reach US$1.1 billion in 2020, surpassing the US$1 billion mark for the first time[2].

As the market records great expansion, why should advertisers invest in audio?

Across Europe, there are several successful native portfolios that advertisers are able to access. In Germany, the Bertelsmann Audio Alliance launched their platform, Audio Now, which plays host to over 150 native podcasts ranging from family to politics. The Alliance captured the consumers’ desire for escapist entertainment and for ways to purposefully reshape themselves during the pandemic through the creation of successful comedy podcast “Die Pochers hier!” and family podcast “Elterngespräch”. In the Netherlands, Dag en Nach Media, commercialised by the Ad Alliance, has 42 podcasts and over 8 million listenings every month[5].

Radio podcasts are also available around Europe. In France, Groupe M6’ stations RTL, RTL2 and Fun are available in podcast formats. Same with Onda Cero in Spain. What benefit, therefore, do both these native and radio podcast portfolios bring to advertisers?

The Bertelsmann Audio Alliance launched their platform, Audio Now, which plays host to over 150 native podcasts

Podcasts reach audiences that are highly attractive for brands; not only do 18–35-year-olds engage particularly well with them, but they also often have university degrees or are budding professionals. In France, 58% of listeners are less than 35 and, in the Netherlands, post-graduates are 68% more likely than the average to listen to podcasts[6]. These listeners, due to their demographic, want authenticity in their content and not the repetition of a corporate message. This is why many advertisers, including Sephora, have tried to appeal to this bracket by creating their own podcasts to increase brand loyalty. However, the fact that podcasts are still mainly found through recommendation makes it difficult to execute this.

By making them more generally available through the creation of dedicated platforms like Spotify and Deezer, podcasts allow advertisers to reach larger audiences. In France, spontaneous awareness doubles when brands couple a live radio campaign with a native podcast one[7], thereby increasing de-duplicated reach. The differing subjects which podcasts tackle also augment reach. In Germany, for example, 52% of listeners consume science-related content[8]. Responsibility, whether environmental or social, is also regularly discussed in podcasts; advertisers may want to align themselves to these themes as they grow in importance as the year goes on.

Not only are these audiences attractive for advertisers and de-duplicated, but they also don’t mind listening to adverts if they’re relevant to the content and if the podcast is free. In France, 78% of listeners don’t mind listening to adverts if this is the case[9]. 88% of French listeners also consider these adverts efficient for sales[10]. In a study carried out by M6, respondents are 22% more prone to say they pay attention to advertising on podcast compared to live radio.

According to a Spotify study, 81% of listeners stated that they have acted on audio adverts and bought a product. However, the advertising has to be pertinent as it is only successful due to the intimate relationship and trust that listeners have in podcasts hosts. The same study by M6 found out that combining radio and podcasts boosts purchase intention. 36% of respondents would tell their relatives about a particular product as opposed to only 33% would on just live radio. Interestingly, 42% of respondents would want to find out about the advertiser if listening on a combination of radio and native podcasts, five percentage points more than the 37% if it were solely on radio.

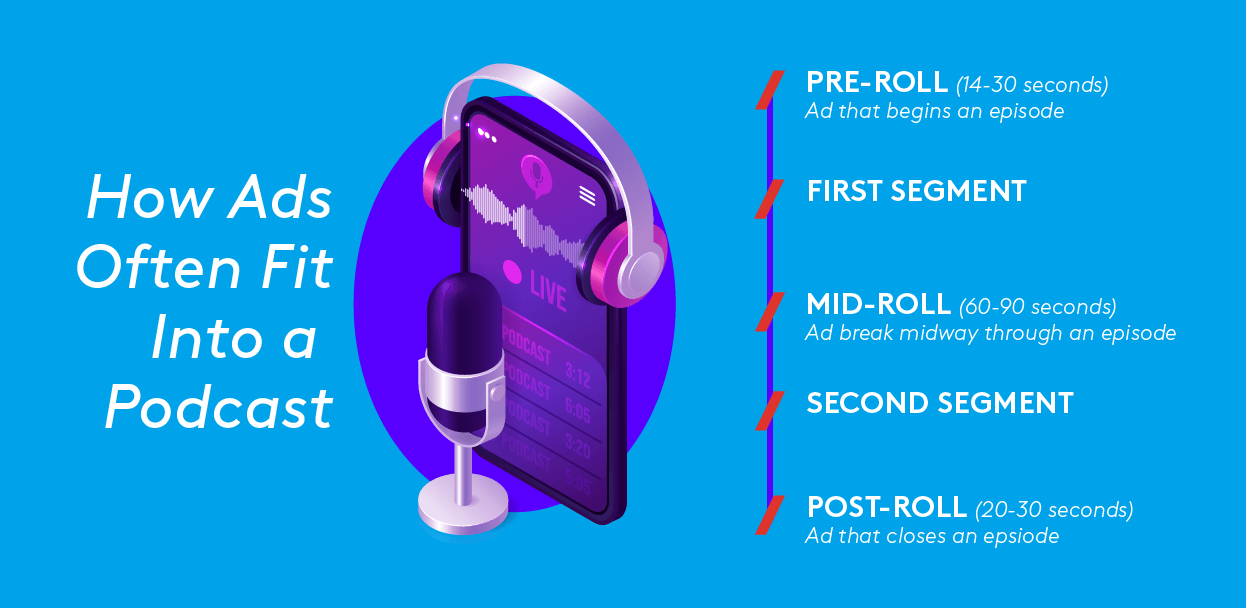

The past year has forced advertisers to assess the ROI of every media investment, podcasts allow advertisers to measure their campaigns performance. Spotify uses a technology called Streaming Ad Insertion (SAI) which gives advertisers the opportunity to track campaigns and to assess their performance. It also provides them with a variety of targeting capabilities to home in on their target group. This technology still follows the traditional podcast advertising formats of pre-roll, mid-roll and post-rolls.

Programmatic buying plays an essential part in advertisers’ media investment strategy. According to e-marketer, 86.2% of all podcasts will have to be bought programmatically by the end of 2021. Programmatic advertising uses AI and algorithms to buy and optimise campaigns in real time. This gives advertisers simplified access to the whole podcast portfolio.

Live radio streaming and web radios respectively increase reach and enhance user experiences

Online live radio comes in two forms, live radio streaming and web radios. Although seemingly identical, there is a subtle difference between the two. Live radio streaming is the internet broadcasting of FM stations on connected devices whilst web radios are exclusive live audio streams on platforms.

Live radio streaming attracts large audiences across Europe. M6 Group’s online streaming offerings attract 40 million streams each month, with rtl.fr specifically getting 23 million of those[11]. These offerings also provide incremental reach of +6%[12] in South Belgium when combined with linear radio campaigns, providing obvious benefits for advertisers. This incremental reach is paired with advanced targeting capabilities, such as linguistic, geographical and device targeting. Pre-roll is the main advertising format available to brands through this medium and is highly effective; 77% of consumers remember a brand from the pre-roll they listened to before the content[13].

DAB+ is a broadcast technology delivered via satellite or terrestrial air waves. DAB+ has taken over from FM radio, replacing analogue technology with digital in the same way as DTT in television. It was launched end of 2019 in Belgium and allowed the launch of new digital radio stations, such as Joe Easy or Willy. 20% of French-speaking Belgians declare listening the radio through a DAB+ platform at least once a month. In North Belgium, DAB+ translates for DPG’s to 18 digital stations, 8 million stream starts and 1.15 unique visitors per month.

77% of consumers remember a brand from the pre-roll they listened to before the content

Audiobooks: a long way to go but with great potential

Awareness of audio books has never been higher. 82% of French internet users know they are available and 17.3% have previously listened to one. However, only 0.9% of users listen to them daily[14]. Why-should advertisers even consider audiobooks a part of their strategy?

Despite low listening figures, 6.6% of internet users aged between 25-34, a highly targeted target group for advertisers, listen to audiobooks in France. These statistics are also increasing year-on-year as 36% of listeners claim to have consumed more audiobook content than the year prior[15]. The time that this content is often consumed is just before bed (40% of listeners attest to this[16]), which is when there are few other distractions to the message delivered. Even though children often are the ones to listen to podcasts, audiobooks are then subsequently listened to by parents accompanying their kids. 61% of French children listen to audiobooks alongside their parents. This allows for an advertiser’s message to reach an audience who can directly affect sales.

What remains clear is that all digital audio, podcasts, live radio streaming and audiobooks, provide advertisers with the opportunity to enhance their ROIs. The podcast market seems set to take off. According to Forrester, the podcast market could see ad revenues of over one billion dollars in 2021. This is due to the consumers it has and their tolerance of adverts, its measurement and targeting capabilities, and its continued innovation. Radio live streaming, meanwhile, takes advantage of radio’s audiences and the targeting capabilities of digital. Although audiobooks have a long way to go, the promise of a growing market and an undistracted audience should intrigue brands. It is therefore high time for advertisers to consider audio a part of every brand’s media investment strategy.

Aurélie Brunet de Courssou, Head of Strategic Planning at RTL AdConnect

Sophia Laassibi, Media Analyst at RTL AdConnect

Sources

[1] Mediametrie Global Audio 2020

[2] Deloitte TMT Predictions 2020

[3] OPINION WAY & SOFINSCOPE – French spending during and after Kantar P3 2020 vs. P3 2019 lockdown / UFC survey que choisir (week 4) / LinkQ tracking Covid PGC+FLS (wave 4, week 5 containment)

[4] M6 Publicité

[5] Dag en Nach Media

[6] Nielsen / MarketingCharts, July 2017, Statistics Dag en Nacht media 2018 (gender) and 2019 (age)

[7] Survey M6 X Harris interractive, Base: 2,065 people aged 25 to 59, listeners of live radio content and/or digital audio, and representative of the French population. Field period: 28 January-8 February 2021

[8] Ad Alliance Germay, study « Mobile 360° »- Q: Which are the topics of the podcasts you listened to?

[9] Study Nielsen for MidRoll Media – Podcast Ad Brand Lift – December 2018 / Study Discover Pods Podcast Trends Report Ad effectiveness – September 2018

[10] Study Nielsen for MidRoll Media – Podcast Ad Brand Lift – December 2018 / Study Discover Pods Podcast Trends Report Ad effectiveness – September 2018

[11] eStat Médiamétrie Scope: World December 2020

[12] Nov19-Oct20; FMix Reach South + Digital audio (Premium & Web), without Deezer /AdWave

[13] Toluna. 1.000 interviews. February 2021. Target: Listening podcast– digital radio

[14] DPG Media

[15] Mediametrie Global Audio 2020

[16] Mediametrie Global Audio 2020